This report examines the state of U.S. infrastructure, where we need to go and the economic effects of taking action. Infrastructure undergirds a modern, competitive U.S. economy. The collection of roads and bridges, airports, water systems, dams and levees, ports and urban transit systems facilitates and helps drive innovation, competitiveness, job growth and productivity.

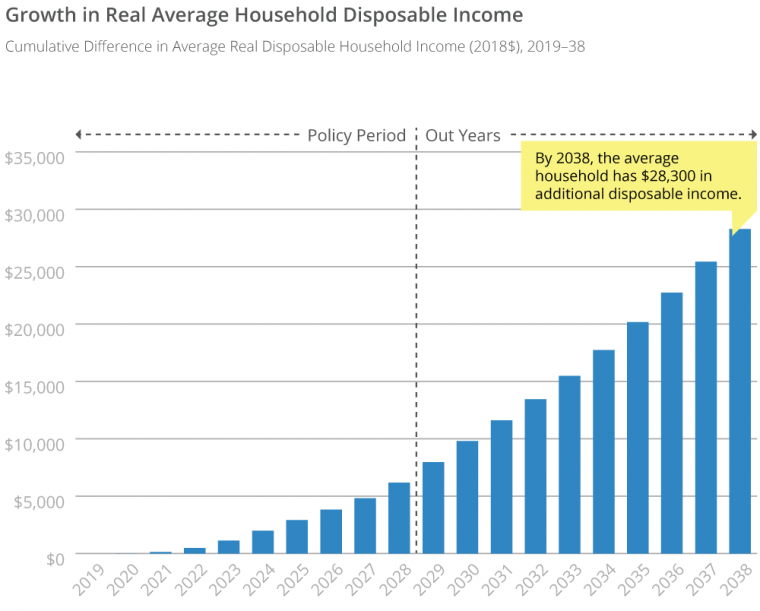

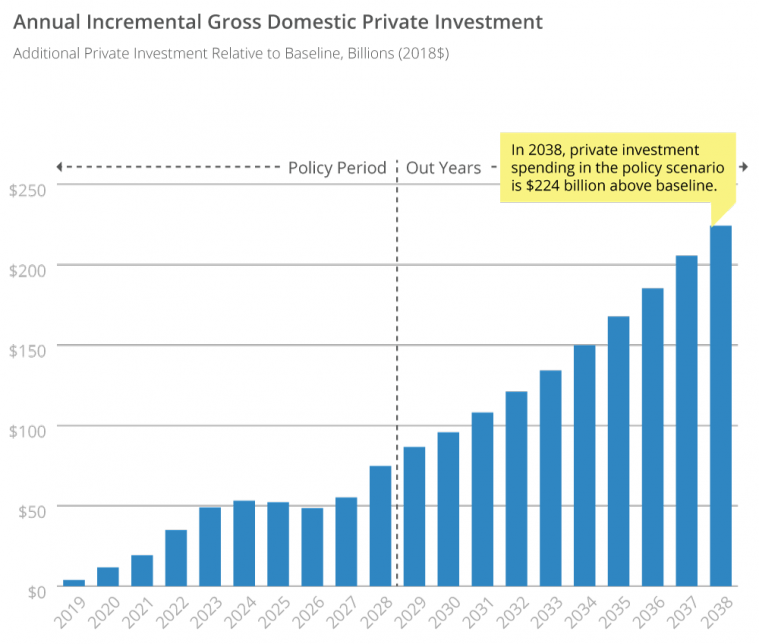

Infrastructure affects us all. For U.S. businesses, every element of economic output depends on the nation’s infrastructure — from the transport of imports, exports and services to our daily commutes. For U.S. households, infrastructure makes America accessible, lowers the costs of everyday goods and activities, helps provide clean water to drink and improves people’s lives.

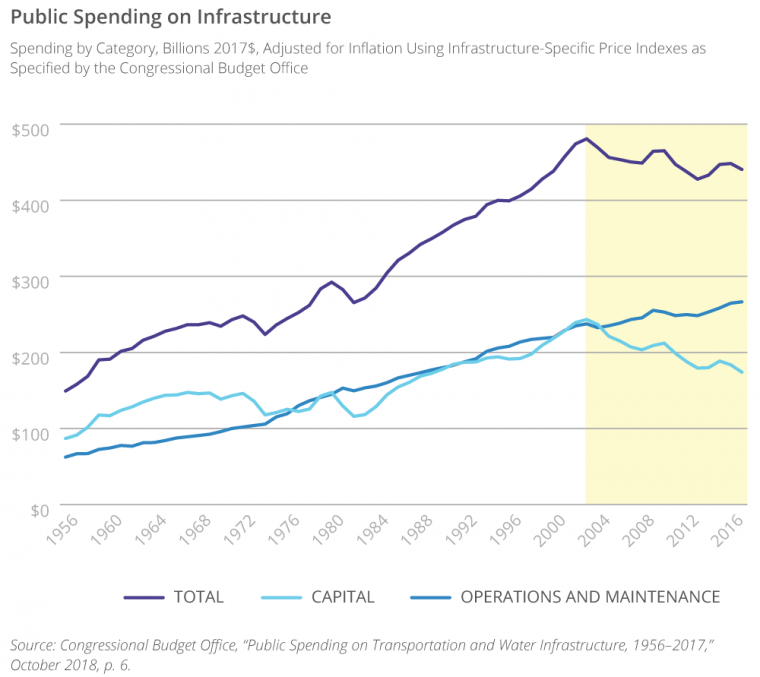

Sadly, America’s infrastructure is falling behind. Public financing has not kept pace with population and economic growth. The growing gap between our needs and our investment threatens not only the quality and reliability of our national infrastructure, but also America’s economic foundation.

It is time to reinvest in America’s infrastructure. Investing in American infrastructure is a prerequisite for delivering job creation, growth and improved living standards for Americans. It is also a catalyst for the connections and creativity that will power the innovation and economy of the future. Meeting this urgent need requires strong leadership that is focused on restoring America’s gold standard of infrastructure excellence.